Senior Financial Planning in NJ: A Beginners Guide for Your Golden Years

It’s safe to say that everyone wants to achieve financial independence. Who doesn’t want to live a stress-free life without worrying about money?

However, financial management can be challenging, especially as you get older.

According to an AARP Financial Security Trends Survey, over 61% of Americans 50+ are worried they won’t have enough funds for retirement.

With rising healthcare costs, inflation, and inadequate retirement savings, seniors are more prone to financial anxiety. But there are ways to effectively relieve financial stress and burdens.

If you live in New Jersey, a financial planner can be an invaluable resource. When you find the right financial advisor, you make smart decisions about your money and plan for the future with comprehensive financial planning.

It’s important to choose a financial planner who understands your financial needs and goals.

Whether you need help with estate planning or tax efficiency, a knowledgeable financial advisor can guide you.

This blog will cover everything you need to know about financial planning for seniors.

Key Takeaways

- A financial planner in NJ can help you make smart decisions about your money for a more secure retirement future.

- There is a wide range of financial services that can be tailored to your unique needs, from investment management services to retirement planning.

- Secure your retirement future by scheduling a consultation with an experienced financial advisor.

Understanding Financial Planning

Retirement is the time when you’re supposed to pursue the things you like and enjoy the fruits of your hard labor.

Now, imagine feeling confident about your financial future, especially during your golden years.

Achieving a more peaceful, fulfilling retirement is possible when you plan for it. Financial planning involves creating a roadmap for your financial future.

This covers areas such as budgeting, saving, and managing debt. It also includes tax planning, portfolio management, and insurance planning.

Types of Financial Planning Services

Financial planning can sound like a big, fancy term, but it’s just about smart ways to handle your money. It covers different financial strategies with their own focus, objectives, and outcomes.

Let’s break down the most common types of financial planning solutions.

Investment Management

Effective investment planning and asset management involves developing an investment strategy that includes proper asset allocation across stocks, bonds, mutual funds, or real estate.

Think of investing as staying healthy. Diversification in investments is similar to balancing cardio, strength training, and flexibility exercises into your routine.

In fitness, you need to keep track of your progress, have regular assessments, and seek advice from a professional trainer.

Similarly in investment planning, it’s important to review your investment portfolio and seek advice from a financial advisor. Both require consistency and patience to achieve significant long-term gains.

A New Jersey financial planner can help you figure out how to balance these investments. By doing this, it’s easier to minimize risks and build a strong financial portfolio.

Risk Management

This involves understanding the risk level of each investment type. For example, stocks might give you higher returns – the catch is it might also lead to bigger losses. Low-risk options like treasury bonds are safer but they offer smaller, more stable returns.

The key is to find a balance that works for you, so your investment portfolio can handle ups and downs.

Tax Planning

The goal of a tax planning strategy is to lower your taxable income and save money on taxes. One way to do this is by using retirement accounts and making charitable donations.

It's like hitting two birds with one stone. You're not just supporting a worthy cause but also making a smart financial move.

Pro Tip:

The IRS encourages everyone to keep detailed records of all expenses that may be deductible. This can make filing taxes easier and ensure you get all the deductions you qualify for.

Estate Planning

This is another area where certified financial planners offer advice and guidance. When planning for the future, you need to focus on how your assets will be managed and protected after your lifetime.

Two key parts of an estate plan are wills and trusts, and beneficiary designations.

A will specifies how your assets will be distributed after death. On the other hand, a trust is an arrangement where you choose a third party or “trustee” who will manage your assets and distribute income to the beneficiaries.

Beneficiary designations pertain to specific accounts like

life insurance policies, retirement accounts, and certain bank accounts. Naming a beneficiary ensures that these assets go directly to the person you choose, bypassing probate.

Retirement Planning

Last but not the least, retirement planning includes managing your 401(k) and IRA for healthcare costs in retirement.

To save pre-tax income, consider contributing regularly to your 401(k) plan. Employers sometimes match contributions, which boosts your overall savings.

IRAs, on the other hand, are individual accounts you set up yourself. Both IRAs are like regular investment accounts, only with tax benefits.

A Roth IRA is funded with after-tax money and offers tax-free withdrawals in retirement; while a traditional IRA offers tax-deductible contributions, reducing your current taxable income.

Financial advisors in New Jersey offer various services, so it’s wise to shop around and find one that best meets your needs.

Key Steps of the Financial Planning Process

Financial planning isn't a one-step approach or a one-size-fits-all solution. Rather, it’s a long-term strategy that involves several steps that need to be followed carefully.

There are five basic steps of financial planning to ensure a more stable, stress-free retirement. From beginning to end, your financial planner can guide you through the process.

Here are the key steps involved:

1. Know Your Financial Situation

This first step serves as a foundation and cornerstone for developing your financial strategy. This is when you should understand where you currently stand financially.

Your financial advisor may ask you about your personal information, existing assets, and liabilities. The key areas to reflect are the following:

- Income: Salary, pensions, social security, and other sources of earnings.

- Expenses: Your monthly spending.

- Assets: Cash, investments, and properties you own.

- Liabilities: Credit card debt, mortgages, and loans.

To give you a clear picture of your overall financial health, your advisor may calculate your net worth by subtracting your total liabilities from your total assets.

As part of the process, you’ll need to gather and compile financial documents like your investment policy statement, bank statements, tax records, and insurance policies.

2. Set Your Financial Goals

Once you have a clear understanding of your financial situation, the next step is to define your goals.

While goal setting seems pretty basic, this step often gets overlooked.

Whether it’s paying off a property or aiming for an early retirement, setting well-defined goals gives you a roadmap for managing personal finances.

Short-Term Financial Goals

These are the goals you aim to achieve from three months to one year.

Examples of short-term goals are building an emergency fund, paying off credit card debt, and saving for a vacation.

When setting short-term goals, be honest and clear about what you want to achieve.

For instance, you may write down “Save $1,000 for an emergency fund in six months" during your consultation with a financial planner.

Long-Term Financial Goals

Think about where you want to be financially in the future. If a goal takes more than five years to achieve, it’s considered a long-term one.

Common long-term goals include having a retirement plan, buying a property, and paying off mortgages.

Since long-term goals have longer timeframes, you need to periodically review your plan and adjust strategies accordingly.

For seniors, these financial objectives might include:

- Saving for healthcare and long-term care expenses.

- Keeping an emergency fund of at least 6 months of expenses to cover unexpected expenses.

- Finalizing your estate plan to ensure assets are distributed properly to heirs.

Having a steady retirement income through pensions, Social Security benefits, and investment withdrawals.

Both short-term and long-term financial goals help you measure progress throughout your financial journey. Without them, it's challenging to track whether you're on the right path or if adjustments are needed.

When you don’t have clear goals, you’ll lack a clear direction and focus, leading to poor financial habits.

3. Develop a Comprehensive Financial Planning Strategy

With your financial objectives in mind, it’s time to get to the nitty-gritty part.

Your comprehensive financial plan should outline specific actions to achieve your goals.

Creating a financial plan sounds intimidating, but it doesn't have to be. Remember that a financial planner is ready to tailor a strategy specific to your needs. This plan should include:

Investment Strategy: Identify the best investment strategies based on your risk tolerance, goals, and time horizon.

Savings Plan: Determine a realistic savings target and set aside a portion of your income to meet your financial goals. Your savings strategy ensures you have enough funds for the future.

Insurance Coverage: Your savings can dwindle when unforeseen circumstances such as a major illness or an accident happen. To avoid this, ensure you have adequate insurance coverage to protect your financial well-being. Some options to include are health, life, and long-term care insurance.

Debt Management:

First things first – list all your outstanding debts, including monthly payments, interest rate, and due date. The key to effective debt management is getting your debt under control and prioritizing those with high interest rates.

4. Implement the Financial Plan

Ask yourself - are you satisfied with the financial plan? If your answer is yes, then it’s time to take action toward your financial success.

The important thing is to carry out your financial plan as early as you can. The longer you delay action, the longer it will take you to reach these goals within your desired timeframe.

Here are some example actions for implementing your financial plan:

- Distribute your assets according to your investment strategy.

- Use a budgeting tool or spreadsheet to track your income and expenses.

- Adjust your spending habits to align with your newly created savings plan.

- Open a high-yield savings account where you’ll keep your emergency fund.

- Start making extra payments towards your highest-interest debt, which is referred to as the avalanche method.

- Consider consulting with a professional to conduct an insurance review.

By taking these specific actions, you can effectively implement your financial plan and make progress toward long-term financial security and success.

5. Monitor and Review Regularly

Financial planning is an ongoing and dynamic process, which means your plan isn’t a one-and-done deal.

Remember that your financial situation will not remain the same throughout your life. At some point, your career, family dynamics, and economic status will likely change.

That’s why you need to review your strategy to make adjustments as needed.

Benefits of Financial Planning for Seniors

Whether you're approaching retirement or already retired, having a solid financial plan makes all the difference.

Let’s dig deep into the key benefits of financial planning and how it can positively impact your life:

Peace of Mind

One significant benefit of financial planning is the peace of mind it brings.

Since financial planning helps you manage your money, you know where your money goes and where you can cut spending. You’re also unlikely to worry about financial blunders.

When you have a comprehensive financial plan in place, it’s easier to focus on enjoying your retirement.

Financial Independence

When you’re financially independent, it means you have enough resources to cover your living expenses without relying on a paycheck. Having control over your finances allows you to live comfortably without relying on family or external support.

Financial planning is a powerful tool that provides a clear path to financial freedom. It empowers seniors to create a reliable income stream through pensions, investments, and other sources.

Start your financial planning journey today and take control of your financial future by reaching out to a New Jersey financial planner.

Effective Healthcare Management

Seniors often spend a large portion of their money on medical expenses.

According to the National Institutes of Health, older adults use far more healthcare services than younger groups. That’s because seniors have weaker immune systems.

With rising healthcare costs, seniors must prioritize effective strategies to ensure access to quality care. Financial planning allows seniors to allocate funds for medical expenses and long-term care.

Maximized Retirement Benefits

Strategic planning of income sources like social security, workplace plans, and pensions can maximize your retirement benefits.

Suppose you have savings in various accounts, such as a 401(k) plan and an IRA. The right financial advisor can help you choose the best withdrawal strategy to maximize your benefits while reducing taxes.

When you implement your strategy properly, you can save enough money for retirement and achieve financial stability.

Financial Planning Tips for Seniors

Financial planning for seniors requires careful consideration of various factors unique to this stage of life.

Here are some practical tips to help seniors manage their finances effectively:

Start Saving Early

There’s no ideal time when you should start planning for retirement. But it’s advisable to start as early as you can.

The secret to financial security in your senior years is being proactive about planning. The earlier you start, the more time you have for saving and investing your money. By saving early, you can take advantage of compound interests and grow your wealth more.

Moreover, proactive financial planning gives you the chance to minimize risks and adjust your strategy accordingly.

Track Your Money

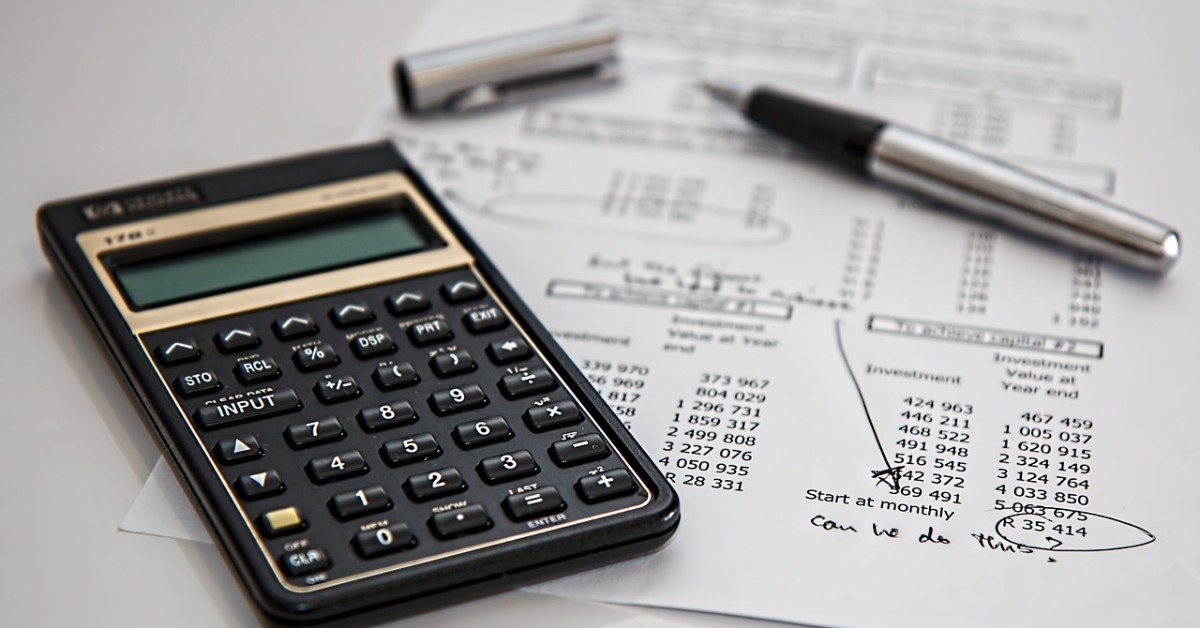

Listing all your income and expenses will help you live within your means. A simple budget plan in a spreadsheet can give you a sense of your monthly cash flow.

When creating a simple budget plan, make sure to include all sources of income and categorize your expenses. If your income isn’t enough to cover your necessities, either find ways to increase your income or cut your monthly spending.

The most common budgeting framework is the 50/30/20 rule:

- 50% of net pay for needs (rent, utilities, and groceries)

- 30% of net pay for wants (entertainment, shopping, and travel)

- 20% of net pay for (savings, emergency fund, and debt repayment)

Protect Yourself Against Scams and Fraud

Did you know there’s a term called “elder fraud?” This involves financial scams targeting older adults. According to the Federal Bureau of Investigation (FBI)’s Internet Crime Report 2022, there were 88,262 fraud complaints from people aged 60 and above.

Seniors often fall victim to investment scams, identity theft, and phishing emails.

Always take precautions and be informed about these common financial scams. As much as possible, avoid unsolicited phone calls, emails, and investments that seem too good to be true.

Seek Advice from Financial Advisors

Working with a financial planner specializing in retirement planning can be instrumental to your financial success.

A good financial planner takes the time to understand your financial situation and retirement goals.

If you’re looking for a financial advisor in New Jersey,

Leonard Financial Solutions is here to assist you. From creating personalized strategies to optimizing your finances, we got you covered!

The Importance of Choosing a Financial Planner NJ

When it comes to picking a financial advisor, working with a local financial advisor in New Jersey can make a big difference. You’ll benefit from their local knowledge, network, and personalized service tailored to your community.

Choose a fee only financial advisor to get unbiased advice. They are paid only through straight-forward fees from clients. They do not earn commissions from selling financial products, which reduces conflicts of interest and increases transparency compared to fee-based advisors.

Local Knowledge

A local financial advisory firm knows the ins and outs of the area’s economic landscape. They also know about state tax regulations, local investment opportunities, and financial challenges Nrresidents face.

Having such exclusive insight means they can offer financial and investment advice tailored to your needs.

Choosing an advisor that lives within the same community means you may share common interests and values. This can create a more cooperative and satisfying advisor-client relationship.

Wide Network of Professionals

Local financial advisors might have connections with other professionals like lawyers and real estate agents.

Let’s say you're looking to buy a house or property. A financial advisor with a strong local network can introduce you to reliable contacts, making the process smoother and faster.

Moreover, local advisors often attend community events and meetings. They are likely to go to events to stay updated on neighborhood developments.

With such a connection to the community, they can provide updates on any changes that could impact your finances.

Personalized Approach

A financial advisor within your community is likely to offer a personalized approach. They can schedule in person meetings with you more frequently. Such direct interaction helps build trust and allows your advisor to understand your financial goals better.

Building a personal relationship means your advisor can give advice that feels more relevant and specific to you.

Choosing a local advisor makes financial planning more effective and enjoyable. Their local knowledge and personalized service provides a meaningful advantage over advisors who might not have the same level of community connection.

Reach Out to a Financial Advisor Today

Are you ready to take charge of your financial future?

At Leonard Financial Solutions, we help empower retirees to navigate their financial journey with confidence and peace of mind.

Whether you're looking to maximize your retirement income or create an estate plan, we have experience to guide you every step of the way.

What’s in it for you?

- Tailored Solutions: We understand that no two retirees are alike. That's why we take a personalized approach to financial planning for retirees like you.

- Comprehensive Services: From retirement income planning to personalized wealth management, we offer a wide range of services designed to cover aspects of your financial life.

- Trusted Partner: With Leonard Financial Solutions by your side, you know that you’re working with someone who knows what they are doing. We assure you that your best interests always come first.

So why wait? Take the first step towards securing your retirement future today. Booking a free financial consultation with Leonard Financial Solutions is easy:

Simply fill out the calendar on our website and choose your preferred consultation date and time. Our dedicated financial planners in New Jersey stand out in the financial planning industry.

Schedule a consultation and discover how we can help you achieve your financial goals!

FAQs

LEONARD FINANCIAL SOLUTIONS

Start Planning Your Secure Retirement Today

We are dedicated to helping you achieve a safe and secure retirement. Whether you're in New Jersey, or anywhere in the United States, our independent fiduciary team is here to provide expert guidance tailored to your needs.